April 23, 2024, 19:48 PM ET Written by Bill T. – Contributor | Editor: Thomas H. Kee Jr. (Follow on LinkedIn)

PFL Long Term Trading Plan Buy PFL just above target of 7.92 8.33 Stop Loss @ 7.9 Details

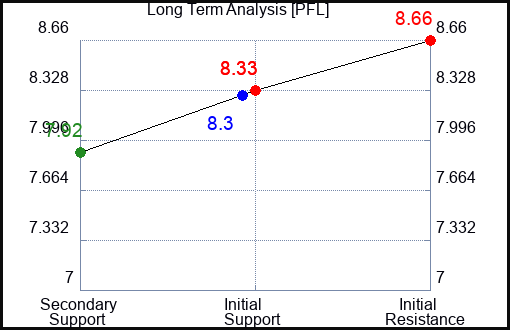

According to the technical summary data, the upside price target is 8.33 and PFL should be bought around 7.92. This data also shows that the stop loss should be set at 7.9 to prevent excessive losses if the stock starts to move against the trade. 7.92 is the first support level below 8.3, and a test of support is generally a buy signal. In this case, a buy signal exists as support 7.92 is tested.

Short PFL ~8.33, Target 7.92, Stop Loss @ 8.35 Details

The technical summary data is suggesting a short on PFL as it approaches 8.33 with a downside target of 7.92. However, the stop loss should be set at 8.35. 8.33 is the first resistance level above 8.3, and by rule, testing resistance results in a short signal. In this case, if resistance 8.33 is being tested, there will be a short signal.

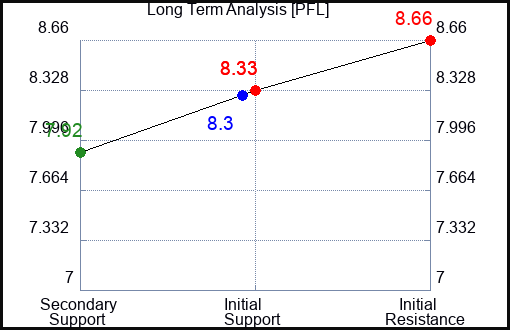

PFL Swing Trade Plan Buy PFL just above 8.33, Target 8.66, Stop Loss @ 8.31 Details

If we start to break above 8.33, our technical summary data suggests we should buy PFL just above 8.33, with an upside target of 8.66. The data also tells us to set a stop loss at 8.31 in case the stock trades against us. 8.33 is the first resistance level above 8.3, and as a general rule, a break above the resistance is a buy signal. In this case, the initial resistance at 8.33 is breaking out, so there is a buy signal. This plan is called a long-term resistance plan because it is based on interruptions in resistance.

Short PFL is slightly closer to 8.33, target is 7.98 and stop loss is 8.35.detail

Technical summary data suggests PFL is short if it tests 8.33 with a downside target of 7.98. However, you should set a stop loss at 8.35 in case the stock starts moving against the trade. As a rule, all resistance tests are short signals. In this case, when testing resistance 8.33, a short signal is present. This plan is called a short-term resistance plan because it is a short-term plan based on testing resistance.

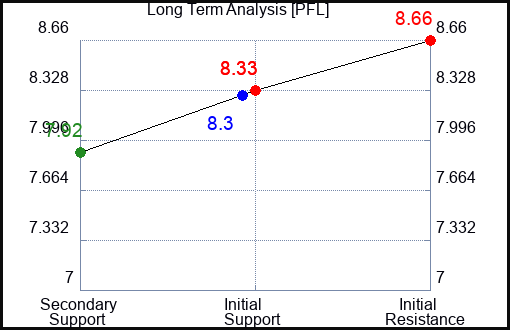

PFL Day Trading Plan Buy PFL just above 8.34, Target 8.66, Stop Loss @ 8.32 Details

If we start to break above 8.34, the technical summary data suggests we should buy PFL just above 8.34, with an upside target of 8.66. The data also tells us to set a stop loss at 8.32 in case the stock trades against us. 8.34 is the first resistance level above 8.3, and as a general rule, above resistance is a buy signal. In this case, there is a buy signal as the initial resistance at 8.34 is breaking out. This plan is called a long-term resistance plan because it is based on interruptions in resistance.

Short PFL is slightly closer to 8.34, target is 7.98 and stop loss is 8.36.detail

The technical summary data suggests that PFL is short if it tests 8.34 with a downside target of 7.98. However, you should set a stop loss at 8.36 in case the stock starts moving against the trade. As a rule, all resistance tests are short signals. In this case, when testing resistor 8.34, a short signal is present. This plan is called a short-term resistance plan because it is a short-term plan based on testing resistance.

Real-time updates are available on the Pimco Income Strategy Fund Beneficial Shares (PFL) page (PFL).

PFL Ratings as of April 23rd:

Period → Medium to long term rating Strong Weak Strong P1 0 0 7.92 P2 8.34 7.98 8.33 P3 0 8.24 8.66 PFL support and resistance plot chart

Blue = current price

red = resistance

green = support

Real-time updates for repeat institutional readers: Instructions:

Under[リアルタイム更新を取得]Click the button.

At the login prompt, select “Forgot your username?”

Enter the email you want to use for FactSet

Log in using the user/pass you received

Access real-time updates 24/7.

From then on, you can always get real-time updates with just a click.

Get real-time updates

Our market crash leading indicator is Evitar Corte.

Evitar Korte has warned of the risk of a market crash four times since 2000.

We identified the internet disaster before it happened.

We identified the credit crunch before it happened.

Corona shock was also identified.

Check out Evitar Corte’s comments.

Get notified when ratings change: Try a trial version

Price is the most important factor in making money in the #stock market. Stock Traders Daily celebrates his 20th anniversary and offers tools to help you develop your investment strategy. This is a good example. Combining this with market-based analysis increases your odds of going with the flow, which becomes more important over time. The Pimco Income Strategy Fund Beneficial Shares (NYSE:PFL) report below will help, but there is more detailed information as well. Trading plans for PFL and the other 1000+ stocks we follow are updated in real time for our subscribers, but this report is static. If you need an update or another report, get unlimited real-time reports here.

Basic chart of PFL:

Source link